This year has been a year of many manga bankruptcies. While Diamond is the largest company, October’s Chapter 7 filing for humanoids is also noteworthy, particularly in France. The original company, Les Humanoïdes Associés, is a very famous publisher, and some of the greatest names in French comics have been published there. The U.S. branch filed in the fall, while the French arm had already filed for receivership over the summer.

The outline of Humanoid’s downfall seems pretty clear – the French publishing world as a whole has been in a precarious situation lately due to a number of factors, and Humanoid in the US was hit hard by the bankruptcy of Diamond – but there are undoubtedly many interesting details. Now, reporter Antoine Woolley has published a two-part investigation into what happened in the French publishing news magazine ActuaLitte. You can read Part 1 here and Part 2 here. Since these are in French, I read them using Google Translate, but some parts may literally have been lost in translation. But this is a well-researched and reported story, so here’s a summary.

Much of it revolves around Fabrice Giger, the publishing magnate who bought Humanoid in 1988 at just 23 years old. Giger continued to run the company, opening a U.S. branch a decade later, but the bankruptcy filing revealed the usual web of investors and shell companies.

Reading these stories, at least in translation, the major factor behind the fall of the humanoids appears to be Giger’s quest to become a film producer and his relentless pursuit of The Big Lie (Translated by Google).

At Les Humanoids Associées, a different direction is emerging. “In recent years, publishers have been forced to choose comics with high audiovisual potential, resulting in the publication of many low-quality publications. The focus was not on the intrinsic properties of the comics, but on their adaptation potential,” explains a former employee of Les Humanoids Associés. This strategy reportedly changed slightly when Marie Parisot, formerly of Dargaud, became CEO in 2024.

For those of you who aren’t familiar with our Big Lie theory, it’s the idea that making a movie out of a comic book is more profitable than just having a strong backlist. Unless you somehow become a producer and get a $1 part in a project that becomes an international blockbuster… it’s not that easy. Giger learned that the hard way.

Perhaps inspired by the cult status of the original heavy metal animated film, Giger pursued a deal with Hollywood without much success until 2021, when Humanoid made headlines with a deal with Taika Waititi to direct the film based on the classic Inkal comic by Alejandro Holodowski and Moebius. Part of it is the story of the unfilmable acid trip, but there have been many film attempts over the years, and Waititi is definitely the director that comes to mind when the words “unfilmable acid trip” come to mind. But Waititi was in the midst of his own troubles, and this was one of many projects he was involved with that never came to fruition.

Meanwhile, back in France, the Humanoid project was getting airtime, but it was not very successful and was all under the control of Sparkling, the production company owned by Giger, Oury said. Cannes Confidential (not based on a comic) aired on Acorn in the US and on TF1 in France, but the ratings were abysmal. Another show, Whiskey on the Rocks, is on Hulu, but to be kind, I don’t know. In comic book-based media, Jerry Frissen and Guy Davies’ adaptation of Zombies Ate World was released in 2024 under the title We Are Zombies, but it was only screened at film festivals. As you can see from the above, just producing a few movies and TV shows still won’t save a company from bankruptcy. It has to be a hit.

In pursuit of success in Hollywood, Giger teams up with David Jordan, who runs Primer Entertainment, which has acquired a 20% ownership interest in Humanoid US, but here we find another sadly familiar story. The U.S. bankruptcy involves a dispute between Giger and Jordan, with Jordan claiming Giger owes him $10 million. The case is currently in arbitration.

There is much more to the fall of the humanoid in France. Mr. Giger visited his Paris office over the summer and shocked his employees when he called a surprise meeting and told them that they would not be able to pay their salaries and that the company would be liquidated. La Boîte à Bulles, a small publishing company acquired by Humanoids in 2017 that suffered financial difficulties earlier this year, appears to be in near-Chapter 13 status in the United States and is currently undergoing reorganization.

This story has a lot to do with French labor laws (which tend to be stronger than those in the US) and bankruptcy proceedings. For example, Humanoid avoided stricter labor laws by not having more than 11 employees (which could lead to increased oversight) and by not having a human resources department.

Meanwhile, according to the US bankruptcy filing, Humanoids US has debts of $18,311,623.72 and assets of $0. These debts include $10 million owed by Jordan, $1,252,654.09 in additional loans from Giger himself, and $7,009,547.7 to Humanoid Holding Searle. It includes $2, and Aury describes the company as “a Luxembourg-based company within the Giger Group, majority-owned by Fabrice’s own daughter, Melissa Giger.” Essentially, Humanoids US ended up going bankrupt because they poured too much of their own money into the company.

Although it’s a little unclear in the translated version, Humanoid’s French debt apparently includes two other debts: $411,685 from Giger and $84,321 from his mother, Claudine Giger. French creditors include:

Among them are several French printing companies such as Aubin ($5,275 outstanding), Pollina ($48,855) and Rotofrance ($10,344), but also the Spanish company Estellaprint ($24,468). It should be noted that the magazine “Métal hurlant” is currently printed by Roularta in Belgium.

Among the many other creditors are France International ($3,510), Humensis Group ($5,850 in royalties), Mosquito Publishers ($24,438), and La Chope ($8,893), the catering company for La Belleviloise, the Parisian cultural center where Les Humanoids Associés celebrated its 50th anniversary in March. 2025.

The issue of La Boite à Bulle is similarly intertwined. Last year, founder Vincent Henry, who continued to run the company under Father Humanoid, sold his remaining shares in the company back to Humanoid for €467,400. Henry now claims he was never paid in connection with the deal and that he was never paid the €49,440 he was supposed to be paid for the acquisition. These will be listed on the bankruptcy filing as a $620,000 debt to Henry.

However, in June La Boîte à Bulles was transferred to Sparkling and is now a separate company owned by Humanoids Holding SARL. If you’ve been following Diamond Bankruptcy, you’re probably familiar with the holding company shell games that companies play. While the similarity of the names Sparkling and Sparkle Pop is an amazing coincidence, the efficiency of this type of arrangement is not. La Boîte à Bulles continues to operate, protected from humanoid liability.

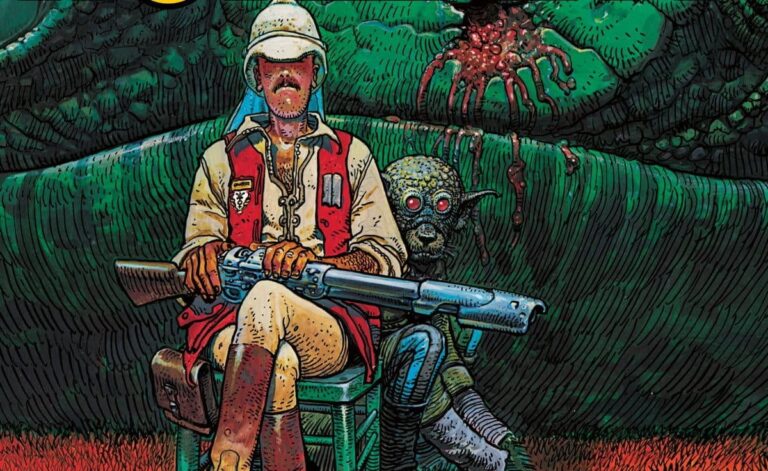

Also, surprisingly, Métal Hurlant, the F/SF anthology that started it all, was successfully relaunched and spun out as the US version of Heavy Metal. Our own RM Rhodes covers the relationship between the two companies in detail here.

Métal Hurlant is produced by Fiction Labs, another Paris-based publisher recently founded by Guillaume Lubrano-Lavadera. Once again (via Google Translate:)

Although the name may not seem particularly relevant to Humanoid, its shareholders include Thierry Frissen, aka Gerry Frissen, a close associate of Fabrice Giger, and Guillaume Nougare, Humanoid’s financial manager and head of the American group in France.

We’re not sure how many different versions of Metal Hurlant continue, but Humanoid’s US store still claims to be selling subscriptions for the US version for $110. Probably not a good idea to order.

Meanwhile, what will happen to the rights to all the books Humanoid has published in English? I’ve heard that some creators are trying to get the rights back, but even with a reversion clause, it’s never going to be easy.

So, another complicated comic book bankruptcy case occurred. But don’t count out Giger. Considering his other existing companies and assets, don’t be too surprised if he pops up somewhere again.

Something like this:

Like loading…